Habitational Insurance

Boise, Idaho Falls, Logan, Rexburg, Rigby, Salt Lake City, Spanish Fork - High West Insurance, Tremonton, Twin Falls - Alta Insurance

Habitational insurance is beneficial because it protects not only the commercial residential property, but it can protect interior furnishings as well.

Request Quote or Contact Us

Please note: coverage cannot be bound or altered online. A service representative will need to contact you to finalize your request.

What is habitational insurance?

At first glance, habitational insurance may sound like another term for home insurance, but it isn’t. You may have also heard this type of insurance referred to as landlord insurance. Regardless of what term you use, habitational insurance can protect you as an owner of a commercial residential property. If you rent out homes, apartments, boarding houses, condos, hotels, or other types of residential properties, habitational insurance is for you.

Habitational insurance is beneficial because it protects not only the property, but it can protect interior furnishings as well.

Your commercial residential property is unique, and you can tailor a policy to reflect its unique needs. Some habitational coverage options include the following:

General liability — covers the cost of property damage or bodily injury that occurs on your business property or as a result of your products, services, or advertising.

Wind, fire, and storm damage — if your property is damaged or destroyed by wind, fire, or a storm, this coverage can help you cover significant expenses. Depending on your area, you may also consider earthquake and flood coverage.

Vandalism and theft — vandalism often requires its own separate coverage as it can be extensive and expensive to repair. You may also be responsible if one of your resident’s property is stolen while it is on your business’s premises.

Signage — Outdoor signs may not be covered by a typical habitational insurance policy. Signage coverage can cover damage done by inclement weather, fire, vandalism, and theft.

Equipment breakdown — Expensive equipment and appliances like central AC units and fridges may suddenly break. Equipment breakdown coverage will help if you aren’t able to afford the sudden replacement of integral equipment.

Environmental cleanup — if any of your tenants are injured or become ill due to pollutants like mold in your property, then you may be faced with litigation. Environmental cleanup coverage can cover cleanup costs and bodily injury.

Who needs a habitational insurance policy?

Habitational insurance is essential for anyone who owns and operates a commercial residential property, regardless of how many tenants you have.

Examples of properties that qualify for habitational insurance include:

- Condos

- Student Dormitories

- Townhomes

- Boarding Houses

- Apartments

- Rental Homes

- Hotels

- Timeshares

- B&B’s

How can I reduce my risk as a landlord?

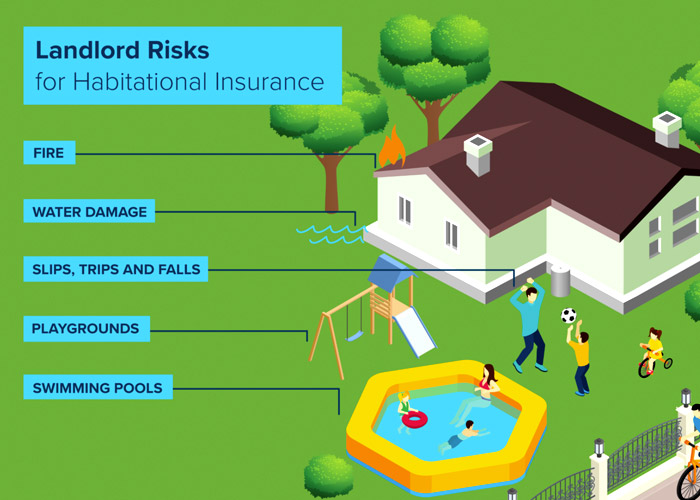

Maintaining an active insurance policy is important, but you can also reduce your habitational insurance risks to keep your premiums down. The top risks you need to be aware of are fire, swimming pools, water damage, slips and trips, and playgrounds.

Fire

The best way to prevent costs incurred by a fire is to take preventative measures. Equipping all rental units with working smoke alarms and regularly maintaining the alarms is key.

The National Fire Protection Association (NFPA) recommends replacing your smoke alarms every ten years and changing the batteries in each alarm at least once a year. You can create an extensive, interconnected net by making sure you have fire alarms in each bedroom, outside each sleeping area, in the living space, and one at least ten feet from the nearest cooking appliance in the kitchen. Make sure to follow the manufacturer’s instructions for installing and maintaining the alarms you have purchased.

Click here to read more details on installing, testing, and maintaining smoke alarms.

Swimming Pools

While swimming pools may attract tenants to your property, it’s vital you follow proper health codes and implement safety measures to keep your tenants safe. If you’re unsure of your local health codes, you can check with your city, county, or state health department.

You can minimize risk by keeping the proper rescue equipment in place and putting up clear, readable signs with the pool rules. Prevent accidents by maintaining a high-quality fence around the pool.

Water Damage

Water damage can be a difficult risk to keep track of. Whenever you enter the premises, keep an eye open for any puddles, stains, or mold. You can also make tenants aware of what water damage can look like so they can report to you if necessary.

Slips, Trips, and Falls

Keep your tenants safe by fixing any uneven floors, walkways, and sidewalks. Minimize any tripping hazards such as worn carpet. In the winter — if there is snow and ice — clear walkways as necessary.

Playgrounds

The best advice for maintaining a safe playground is to follow the guidelines put out by the United States Consumer Product Safety Commission. Their checklist outlines what a safe playground looks like in an easy to read and follow manner.

You can also take preventative measures by frequently inspecting your property’s electrical, plumbing, appliances, HVAC, and roofing, and updating them as needed.

As professionals in the field of habitational insurance, we make it our business to know you and your concerns. We spend time learning and listening to better serve you, our clients.

You’ve worked hard to build your business. The next step is to protect it. We’ll assess what your risks are and help you tailor an insurance policy for your business.

We’d love to chat with you. Contact us today!

Frequently Asked Questions

-

How much does trucking insurance cost?

Your commercial trucking insurance premium can vary a lot from someone else's, even if you're in similar situations or have similar policies. Some factors that affect premiums include:

- The type(s) of vehicles you're insuring.

- How far vehicles are traveling per year.

- Types of cargo. Drivers' driving records.

- The location of your center of operations.

- Standard operating radius.

- How you store the vehicle(s).

- Amount of coverage you opt for.

As commercial trucking insurance professionals, we strive to know you and your worries. We spend time listening and learning to serve you better and help you find solutions. You've worked hard to build and promote your trucking operation. The next step is to protect it. We'll assess your risks and help you tailor an insurance policy. We'd love to chat with you. Contact Archibald Insurance Center today!

-

What does trucking insurance cover?

Every trucking insurance policy is a little different from the rest based on your or your company's needs. That said, there are several common coverages you can include when building your trucking liability insurance policy.

-

What kind of insurance does a truck driver need?

Federal guidelines require you to have commercial truck insurance for all interstate transportation. As we mentioned in the first section, only the direct owner of the truck needs to maintain the policy, whether it's an independent contractor or a larger company. The amount of coverage required varies, based primarily on what you're hauling. If your trucking operations stay within a single state, you don't have to worry about the federal insurance requirements. However, you may be subject to state insurance requirements, so be sure to take the time and double check.

-

Do truckers need general liability insurance?

General liability insurance is different from trucking liability insurance. They sound similar but cover very different things. You don't need it like you need trucking insurance, but it's still very beneficial coverage to have. With general liability insurance, you cover things associated with business, not trucking or transportation themselves. A couple of these coverages include:

- Bodily injury and property damage that occurs due to a covered incident.

- Personal or advertising injury.

-

How does commercial trucking insurance work?

Out of all the types of business insurance available, trucking insurance is one of the more unique ones. Yes, it protects trucks that transfer products and goods from one place to another, which isn't anything groundbreaking. What makes commercial trucking insurance special is how it's purchased. If you're an independent trucker with your own big rig or semi, then you buy it for yourself. Or you may be part of a larger trucking company that owns the vehicles outright. In this case, the company is responsible for insuring the trucks. Regardless of who purchases the policy, trucking insurance is there for you when commercial auto insurance just won't cut it. Trucking usually requires many straight hours of driving, often across state borders, and involves many unpredictable risks. Between the constant wear and tear on the machinery and environmental factors on the road, you need insurance that'll be there, rain or shine.

-

Who can use trucking insurance?

You already know trucking isn't isolated to a single industry or specialty good. In fact, in 2020, 72.5% of the total domestic tonnage shipped was transported by truck. There are many types of trucks on the road, and trucking liability insurance can account for them all. A few examples of companies and trucks that can use commercial trucking insurance include: Livestock Trailers and Movers Moving Companies Delivery Drivers Container Haulers Cement Mixers Tow Trucks Box Trucks Construction Material Movers Dump Trucks Automotive Haulers

-

What risks does rafting insurance cover?

Even if your guests have signed a waiver, you risk a lawsuit or liability claim if something goes wrong on your excursions. We provide coverage solutions for a variety of exposures faced by white water rafting outfitters and guides, including:

- Equipment rentals

- Guided water trips

- Office/facility for rental purchases and instruction

- Equipment storage areas

- Transportation to and from the water

- Food and beverage concessions

- Instruction

- Camping

- Hiking

- Retail sales

-

What type of rafting insurance do I need?

The exact coverage you need will vary based on your business’s operations. However, some types of insurance can benefit almost every rafting business.

- General Liability – Protects your company against bodily injuries, property damage, product damage, and more.

- Commercial Auto – Even if you use a personal vehicle for work, a personal auto insurance policy doesn’t cover the car while it’s used for work purposes.

- Watercraft and Boat Liability – Can cover costs for boat repair or replacement, damage to someone else’s property, and medical bills when people are injured.

- Retail Property Coverage – Offers commercial structures, business personal property, and machinery protection.

- Inland Marine Equipment Coverage – You can protect stored equipment in an off-site location and any equipment you’re transporting.

- Workers Compensation – If any employees are injured or become ill on the job, this insurance can cover the payment of their medical expenses, lost wages, and rehabilitation costs.

-

Do I need rafting outfitter and guide insurance?

Do you rent rafts or give rafting lessons? Do you guide clients across waterways or downriver? Or are you hosting a special event that includes rafting? If yes, you should consider purchasing a rafting insurance policy.

-

What risks does rafting insurance cover?

Every rafting insurance policy is unique, meaning every policy premium will also be unique. Because there’s so much variation between rafting businesses, there’s no precise estimate for your premium. However, we can tell you what factors may influence how much you pay.

- Your business’s location

- Claims history

- Size of your operation

- Number of employees

- Your chosen deductible

- Amount of coverage you choose

-

Who needs malpractice insurance?

Medical malpractice insurance is essential for anyone who provides healthcare services. You may be covered under your employer. However, this coverage may have limitations, so make sure to find out what these limitations are from your local Archibald Insurance Center insurance agent.

Remember, it's not just physicians and surgeons who need medical liability insurance. Other medical professionals can benefit from coverage, including:

- Social workers

- Therapists

- Counselors

- Physical therapists

- Pharmacists

- Nurses

- Dentists

- Radiologists

-

What does medical liability insurance look like?

Claims-made and occurrence policies are the two most common coverage options. While both give you a second line of defense, they have key differences.

Claims-made policies only cover a claim if both the treatment occurred and the lawsuit was filed while the policy was active.

Occurrence policies will cover claims that take place during the coverage period, even if the treatment did not occur during the active policy.

-

What is medical professional liability?

You may have heard other names for this type of insurance such as medical liability insurance, malpractice insurance, and medical malpractice insurance. Regardless of what term used, medical malpractice insurance provides a second line of defense if you are faced with a malpractice lawsuit. You can tailor a policy to fit your unique needs. Some coverage options include the following: Misdiagnosis Surgical errors Medication errors Childbirth-related injuries Anesthesia administration errors Settlement costs Punitive and compensatory damages Attorney and court costs Arbitration

-

Is medical malpractice insurance required near you?

Medical professional liability insurance requirements vary from state to state. Malpractice insurance is required in these states:

- Colorado

- Connecticut

- Kansas

- Massachusetts

- New Jersey

- Rhode Island

- Wisconsin

The following states have claim-assistance programs requiring you to have a minimum amount of malpractice insurance coverage to participate:

- Indiana

- Louisiana

- Nebraska

- New Mexico

- New York

- Pennsylvania

- Wyoming

-

Who needs manufacturing insurance?

Anybody with a manufacturing company. Consider doing a brief self-evaluation by asking yourself the following questions:

- Does your company have the finances to survive a mass product recall?

- Can your manufacturing facility afford excess downtime if a natural disaster happens?

- Will you be able to repair or replace heavy machinery if it breaks down?

If your answer to any of these questions is yes, it is strongly recommended that you protect yourself and your business with manufacturing insurance.

-

What affects manufacturing insurance premiums?

You run a unique company with unique factors and risks. Each factor and risk play a part in determining your company's manufacturing insurance premiums. Some of these risks and factors include: Specific Industry Your Recommended Insurance Limits Use of Heavy-Duty Machinery Presence of Hazardous Materials Vehicles Number of Employees Claim History As professionals in manufacturing insurance, we make it our business to know you and your concerns. We spend time learning and listening to better serve you, our clients. You've worked hard to build your company. The next step is to protect it. We'll assess what your risks are and help you tailor an insurance policy for your company. We'd love to chat with you. Contact us today!

-

Do you or your employees act as specialists providing custom design and manufacturing services that may cause a client financial damage through any errors or omissions?

If so, then you should maintain a professional liability policy. You work hard to perform your duties and responsibilities to the best of your ability, but you may face a lawsuit if your customer isn't satisfied. Protect your employees, your business, and yourself with a professional liability policy.

-

What is manufacturing insurance?

The term manufacturing insurance covers a wide range of policies available for purchase by manufacturing companies. There isn't one, all-encompassing insurance policy for manufacturing that will cover your entire range of risks. However, there is an upside. Because your company is unique, you can tailor coverage to best fit your company's needs. You can find coverage options for all types of manufacturing. Some examples of different manufacturers include: Bottling and Canning Clothing Manufacturers Textile Creators Electronics Machinery Forging Casting Meat Packing Plant Printers Furniture Manufacturers

-

What manufacturing insurance coverage do I need?

The exact coverage you choose will vary because your company and its risks are unique. However, there are some core policies we strongly recommend for all manufacturing company owners.

- Workers Compensation

- Commercial Auto

- Professional Liability

- Business Owners Policy (BOP)

The coverages listed above don’t cover everything. Depending on your manufacturing company, you may also benefit from the following policies:

- Earthquake

- Umbrella

- Equipment Breakdown

- Manufacturers Errors and Omissions

- Product Recall and Replacement

-

What type of insurance do loggers need?

The exact coverage you purchase will depend on your needs. Not every logging business is the same, which means no two logging business insurance policies in Oregon will be the same either. However, there are general coverages any logging company should consider.