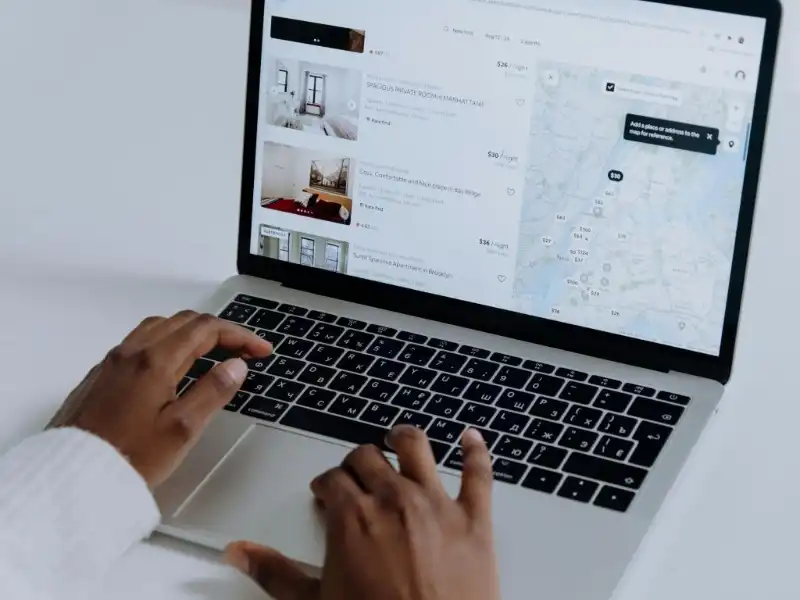

In this blog post, we'll explore why insurance coverage for your short-term rental is essential, whether your homeowners insurance is enough, and if additional coverage is necessary beyond what rental platforms offer.

Why does my short term rental need insurance coverage?

Hosting guests in your home, even for short periods, comes with inherent risks. Here's why having insurance specifically for your short-term rental is important:

- Property Damage: Guests may accidentally damage your property. Insurance can cover repairs or replacements, ensuring you're not left with hefty bills.

- Liability Protection: If a guest is injured during their stay, you could be held liable. Insurance can help cover legal fees and medical expenses, protecting your assets.

- Loss of Income: If your rental becomes uninhabitable due to covered damage (like a fire), insurance can compensate you for the income lost during repairs.

Having insurance tailored for short-term rentals gives you peace of mind, knowing you're financially protected against unforeseen events.

Will my homeowners insurance cover my short-term rental?

Typically, standard homeowners insurance policies may not provide adequate coverage for short-term rentals. Here's why:

- Business Activity Exclusion: Renting out your property for profit might not be covered under a standard policy, as it's considered a business activity.

- Limited Liability Coverage: Homeowners insurance may have lower liability limits compared to what's needed for rental activities.

- Property Use Restrictions: Insurers may require a different type of policy to cover properties used for short-term rentals.

It's crucial to review your homeowners insurance policy carefully or consult your insurance provider to understand what coverage you have and if it's sufficient for hosting guests.

(for more information on what a standard homeowners policy does cover, check out this blog)

Why do I need additional coverage, other than what the rental company (Airbnb, VRBO, etc.) provides?

Rental platforms like Airbnb and VRBO offer some insurance coverage for hosts, but it's often limited. Here's why you might need additional coverage:

- Coverage Limits: Platform-provided insurance may have caps on coverage amounts, leaving you exposed to higher costs in case of significant damage or liability.

- Coverage Gaps: Platform insurance may not cover certain types of damage or incidents, leaving you vulnerable to out-of-pocket expenses.

- Personal Belongings: Your personal belongings might not be covered under platform insurance if they're damaged or stolen during a guest's stay.

To fill these gaps, consider additional insurance options such as:

- Short-Term Rental Insurance: Policies specifically designed for short-term rentals can provide comprehensive coverage including property damage, liability, and loss of income.

- Umbrella Liability Insurance: This can provide additional liability coverage beyond what your primary insurance policies offer.

Hosting a short-term rental can be rewarding, but it's essential to prioritize your financial security with adequate insurance coverage. While platforms like Airbnb offer some protection, it's often limited. Review your homeowners insurance policy and consider additional coverage tailored for short-term rentals to safeguard against unexpected costs. Protect your property, finances, and peace of mind with the right insurance coverage today.

Ready to protect your short-term rental? Contact us at Leavitt Elite Insurance Advisors today to discuss your options and ensure you have the coverage you need.

.jpg/500w/webp/60q)